96% of UAVs procured by Ukraine are domestically made – study

In 2024, the Ministry of Defense and the State Special Communications Service purchased 1.5 million drones. This year, the Ministry of Defense is expected to procure 4.5 million drones worth $2.7 billion. About 93% of the funds will be handled through the Defense Procurement Agency.

At the same time, 96% of all drones purchased by the state this year and last are domestically produced, according to a DataDriven study, "Game changer: how opening exports will affect Ukrainian UAV manufacturers," cited by DOU.

The report says there are now more than 500 active drone manufacturers in the country and over 1,000 UAV models.

During the full-scale war, drone production in Ukraine has increased 800-fold: from 5,000 units in 2022 to 4 million by the end of 2024. Meanwhile, four manufacturers control 80% of the FPV drone segment.

2025: the year Ukraine’s UAV market fully takes shape. DataDriven study "Game changer: how opening exports will affect Ukrainian UAV manufacturers"

The study’s authors estimate that investments in the sector exceeded $60 million in 2024. On average, companies raise $1–3 million in seed rounds.

A stronger trend toward mergers and acquisitions (M&A) is expected. This stems from the market taking shape and leading UAV manufacturers’ drive to scale their capabilities not only in drones but also in adjacent sectors. According to Brave1, 30% of drone manufacturers are interested in both buying and selling companies in the future.

Minimum outlays for an investment fund to acquire a stake in a Ukrainian UAV producer at early fundraising stages start at $100,000. Meanwhile, larger, more established manufacturers have the potential to attract sums reaching tens of millions of dollars.

In 2025, the focus is shifting from hardware to software. Companies are zeroing in on autonomous navigation, artificial intelligence, and EW-countermeasure systems. Researchers say this pivot opens a path for Ukrainian firms to the global market, the study notes.

How opening exports will affect manufacturers

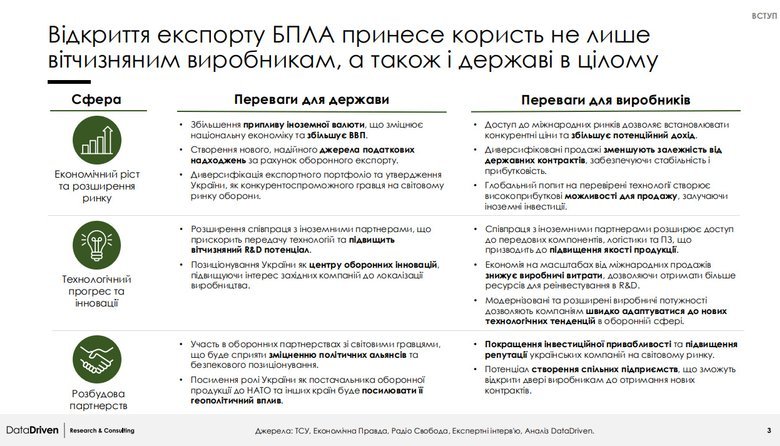

Researchers note that opening up exports will allow companies to diversify sales, reduce dependence on volatile state orders, and secure funds for R&D, while enabling the state to attract foreign currency and strengthen its geopolitical clout.

Opening exports will benefit both manufacturers and the state. The DataDriven study "Game changer: how opening exports will affect Ukrainian UAV manufacturers".

The main challenges to entering the global arena include tough competition with major Western players, reliance on Chinese components, which is problematic for NATO markets, and the need to navigate complex licensing and certification processes.

Exports may also be constrained by a shortage of specialists in Ukraine and lower education quality compared to Western countries.

Read more: Lack of specialists affecting country’s defence capability. What to do?

Apart from NATO and countries with which security agreements have been signed, Ukraine has potential in Asian markets. However, this requires careful oversight to avoid geopolitical risks.

Experts also highlight the prospects for developing domestic production of drone components. The study states that up to 70% of components for FPV drones could be manufactured in Ukraine. This would reduce import dependence and create new exportable products to compete with China.

Earlier, it was reported that 97% of private arms and military equipment manufacturers are awaiting the lifting of export restrictions to begin supplying partner countries, launch joint production, and scale B2B and B2G partnerships.