How to get 8 million to set up processing company

BusinessCensor sorted through fragmented regulations and collected basic information about grants for processing businesses.

Since the beginning of the full-scale invasion, Ukraine has lost its usual logistics routes. The transportation of large volumes of raw materials, which used to be typical for Ukraine, is becoming an extremely difficult task. Especially given the blockade of the Ukrainian border by Poland. Therefore, one of the tasks was to switch from raw materials to products with higher added value.

According to the Ministry of Economy, Ukraine lost almost 30% of its GDP due to the full-scale invasion. In 2023, there was a 5% increase. This year, GDP is expected to grow by another 5%.

To ensure further growth, the Ministry of Economy has initiated programs to support businesses that manufacture products in Ukraine. One of these initiatives is grants for processing.

Last year, the Ministry of Economy, which is the main administrator of the program, together with the State Employment Service, issued 650 grants to representatives of the processing industry. The maximum amount of state aid to each grantee is UAH 8 million.

For this year, it is planned to issue 1,000 grants to processors.

What are the conditions for receiving money?

Grants can be obtained by legal entities (except for state-owned and municipal enterprises), individual entrepreneurs who have already registered, and individuals who are just planning to start a business. A startup applicant applies to the program as an ordinary individual, and after receiving the grant approval, must register as an individual entrepreneur or as a legal entity within 10 days of the grant approval date.

Grants for the processing industry are provided on a co-financing basis.

The maximum amount of state aid is UAH 8 million.

Co-financing is provided on an 80/20 basis (20% is covered by the entrepreneur from his/her own funds) when it comes to businesses in the de-occupied territories or in frontline communities, in the area of active hostilities. That is, out of UAH 8 million, in the case of a business in the above-mentioned territories, the share of the entrepreneur's own funds will be UAH 2 million.

The list of such territories is determined by the Ministry of Reintegration of the Temporarily Occupied Territories.

For the rest of Ukraine, the project is implemented on a 50/50 co-financing basis. That is, to receive UAH 8 million in grants, the entrepreneur contributes UAH 8 million to the project. They can also attract credit funds to the program, but their own funds must be at least 20% of the project.

The grant is for three years and envisages the creation of new jobs.

The idea is that the business must return to the state the entire amount of state support in the form of taxes and fees within three years from the date of receipt of the grant. If the amount of payments turns out to be less, the entrepreneur must return the difference between the amount of the grant received and the taxes actually paid no later than the last business day of the month in which the three-year project implementation period expires.

Military risks

It should be noted that the new employees that the entrepreneur will hire to implement the project for which he received a grant from the state are subject to the general rules of mobilization.

If a processing plant participating in the program is destroyed as a result of the armed aggression of the Russian Federation, the state will compensate the entrepreneur for his or her own contribution to the project.

The process of project registration

A grant application is submitted through the appropriate section on the Diia portal, where the applicant must also upload his or her business plan (a model business plan is published on the portal as an example, and a model business plan form can be downloaded and pre-filled out).

As promised on the Diia page, applying for a grant will take about 20 minutes.

The application from Diia is automatically sent to Oschadbank, which is the project's authorized bank. Oshchad specialists evaluate the potential participants.

The first stage - assessing their business reputation - is automatic. The bot evaluates the company code or individual identification code using databases, including the register of court decisions. It checks the status, debts, and criminal proceedings.

If the entrepreneur has passed this stage successfully, the bank invites him or her for an interview and asks for a number of documents approved by Order of the Ministry of Economy No. 2109 "List of documents for calculating the number of points".

They should be prepared for the interview in advance, as the bank has only 10 business days to make a final decision on the project of a particular applicant.

What can be purchased with the grant funds?

The grant can be used exclusively for the purchase of fixed assets, their delivery and commissioning. That is, these funds are intended to ensure the entrepreneur's technological process and cover his or her equipment costs. For example, when new equipment is needed, or an existing production line needs additional equipment, or when equipment elements need to be replaced.

An entrepreneur cannot receive a grant in cash. Funds for the project are transferred to a special account at Oschadbank. After that, the entrepreneur provides the bank with a payment from the seller for the purchase of equipment, which the bank processes.

Which entrepreneurs can receive a grant and which ones cannot

The recipients of this state support can be a microenterprise, small or medium-sized enterprise. The latter includes a company with up to 250 employees and an annual income of up to 50 million euros.

An applicant may also be a person who has no business experience at all. In this case, they can apply for a grant as an individual.

Another prerequisite for participation in the Program is that the company belongs to section C of the Classification of Types of Economic Activity (СTEA) " Processing Manufacturing".

Therefore, before applying for a grant, it is necessary to check which section the code of the individual entrepreneur or company that wants to receive it belongs to. Or under what economic activity code the future entrepreneur should register.

As a general rule, the processing section includes the processing of materials for the production of qualitatively new products. However, the definition of what constitutes such new products is quite subjective. And the boundaries between the processing industry and other types of economic activity under the СTEA are sometimes not clear enough.

For example, the СTEA includes the processing industry:

fresh fish processing (opening oysters, cutting fish fillets) overside fishing vessels (10.20) (10.20)

pasteurization and bottling of milk (10.51)

furs dressing (15.11)

wood processing (preservation) (16.10)

printing and related activities (18.1)

fid retreading (22.11)

production of concrete ready for use (except for the production of concrete by construction organizations for their own needs directly on the construction site) (23.63)

electrolytic coating, cladding and heat treatment of metals (25.61)

machinery and equipment refurbishment and reconstruction (e.g., refurbishment of engines for motor vehicles, 29.10)

At the same time, they are not classified as processing, for example:

logging, which is classified in section A "Agriculture, forestry and fisheries";

preparation of agricultural products for primary markets, classified in Section A , Agriculture, forestry and fisheries"

Preparation of food for consumption on site, classified in Section 56 "Food and beverage services";

processing of ores and other minerals, classified in Section B, Mining and quarrying;

structural construction and building works performed on a construction site, classified in Section F, Construction;

activities for the division and redistribution of goods into smaller batches, including packaging, repackaging or bottling of alcoholic beverages or chemicals; sorting of solid waste; custom paint mixing; custom metal cutting; all included in Section G "Wholesale and retail trade; repair of motor vehicles and motorcycles".

It is also necessary to check whether the company's activities are included in the list of prohibited activities for obtaining a grant. These include, for example, the production of tobacco products, alcohol, weapons and ammunition.

The full list can be found in the Procedure for evaluating applications, evaluation criteria and the required number of points (score) for making decisions on grant awards (...), approved by the Ministry of Economy. The Procedure specifies other nuances of preparing a project for a grant for the processing industry, the form of a business plan, the form of a grant agreement and the terms of its evaluation, and the deadlines for submitting a project. We can say that this Procedure is a handbook for better preparation for the grant.

How many people should be employed?

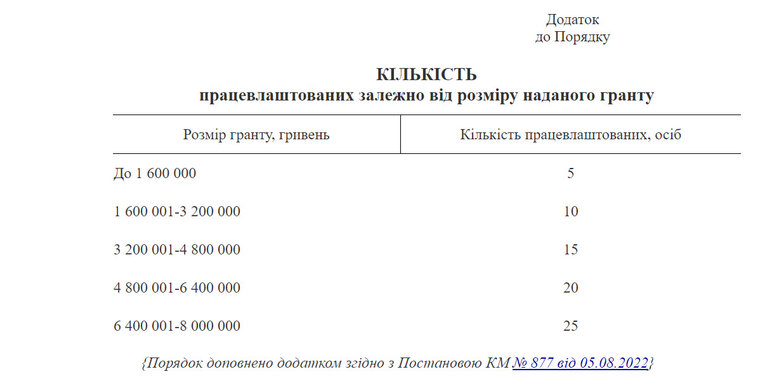

The amount of state support depends on how many employees an entrepreneur plans to hire for their project.

Under the terms of the program, they must hire at least 5 new employees.

To receive the maximum grant amount of UAH 8 million, they must employ at least 25 people.

To fulfill this obligation, the entrepreneur will cooperate with the local employment center, which informs him about the availability of suitable employees from among the unemployed registered there and helps him with recruitment.

If the employment center does not find the necessary specialists, the grantee is responsible for recruiting the employees on their own.

The entrepreneur must provide these jobs in their production for three years.

If employees are dismissed before the end of this period, they must hire other people. To do so, the employer must contact the employment center within five days of dismissing the employee who was employed under the Program.

In case of violation of the obligation to create jobs, the entrepreneur must return the entire amount of the grant to the state within one month.

What are the most common mistakes made by applicants?

As noted in the webinar "Grants for Business. Support for Processing Enterprises", applicants are most often rejected due to misuse of funds. For example, an applicant states that they want to use the grant to buy a tractor, which is a vehicle and cannot be financed under this program.

Under the terms of the program, the applicant may purchase industrial equipment abroad. However, in this case, there is a certain nuance to consider: he can buy equipment for foreign currency for no more than half of his own contribution. The purchase of foreign currency is an additional transaction, which is also interpreted as a misuse of grant funds. Therefore, the rest of the grant must be accompanied by a contract for the purchase of equipment in Ukraine.

If we consider the situation of 50/50 co-financing, for a total of a maximum of UAH 16 million, then equipment can be purchased for foreign currency only for half of the entrepreneur's contribution, i.e. UAH 4 million.

Also, you cannot use the grant for customs clearance of goods, payment of salaries, repairs, etc.

It is also better not to use legal entities that were registered several years ago, but during this period did not conduct any business operations at all, did not show any activity. The Ministry promises that the response to such applicants will be negative.