Why every tenth Ukrainian business faces blocking of VAT invoices

Every month, about 25 thousand Ukrainian companies face blocking of VAT invoices, i.e. every tenth business. How many entrepreneurs pay under the corrupt schemes of the State Tax Service, and will the new rules that came into force on December 9 change the situation?

On December 9, 2023, Cabinet of Ministers Resolution No. 1154 came into force, changing the rules for registering VAT invoices.

This year, the Cabinet of Ministers has already twice amended Resolution No. 1165 regulating the blocking of VAT invoices, but the number of companies facing this problem is not decreasing.

Business Censor assessed the effectiveness of the Risk Assessment Monitoring System (RAMS) in 2023 and whether the new rules will change the state of the business.

Who is subject to VAT blocking

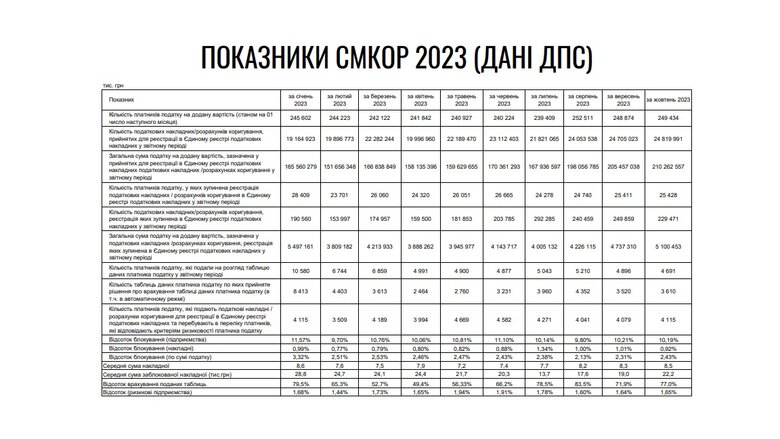

According to a study by the National Agency for the Prevention of Corruption (NAPC), 24-28 thousand companies block VAT invoices every month in 2023. This is 10-11% of those who submitted VAT invoices.

Myroslav Laba, an expert at the Union of Ukrainian Entrepreneurs think tank, emphasizes that the current system slows down the development of the manufacturing sector in Ukraine.

"If a company bought imported jackets and sold the same jackets to the Armed Forces, then it is fine because it has the same product at the input and output. But when an entrepreneur wants to sew these jackets himself, he has to buy sewings, material, equipment, hire employees, and submit a taxpayer's table that the tax service must approve," the expert explains.

However, in the reports of the State Tax Service (STS), the number of blocked VAT invoices is taken as a basis. It amounts to about 1-2% of the total number of submitted tax invoices.

In other words, the STS's view of the problem as affecting less than 1% of businesses is manipulative.

How many VAT invoices are blocked by the RAMS "correctly"

"Out of all 0.9% of blocked VAT invoices, 46% (i.e. almost half) do not even submit documents for unblocking. And this already indicates the fictitiousness of the relevant transactions. When you are asked to open a suitcase at the airport, you pretend that it is not yours, the likelihood that it contains a bomb increases many times over," Danylo Hetmantsev, chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, explained in an interview with Delo.ua.

The main indicator of the effectiveness of the RAMS, which the STS relies on, is the share of blocked VAT invoices that companies do not appeal.

In a realistic scenario, most tax invoices are appealed. According to the Union of Entrepreneurs of Ukraine, out of 25 thousand companies whose tax invoices are blocked monthly, 20 20,000 file complaints, and 19 of them are satisfied by the tax service.

"This means that out of 25,000 companies, 19,000 were blocked in vain," emphasizes Myroslav Laba. "The state interprets that the 5,000 companies that did not file a complaint have actually confirmed that the system blocked them correctly.

But these 5,000 companies in many cases do not challenge the blocking not because the transaction is fictitious. They either don't have the money to support it or the amount of the VAT invoice is insignificant.

It turns out that in 76% of cases, the RAMS blocks VAT invoices by mistake. The figure of 46% of VAT invoices for which no documents are submitted for unblocking is artificial because it is impractical for businesses to collect documents for small amounts.

The question arises: how much do these 46% contribute to the state budget?

According to the State Tax Service's 2023 report, the total amount of VAT on suspended VAT invoices for which documents were not submitted to the State Tax Service commission is UAH 167.9 billion. These data were made public by Yevhen Sokur, Acting Deputy Head of the State Tax Service of Ukraine, at the round table "Blocking Tax Invoices: Corruption Risks and Ways to Overcome Them" held at the NACP on December 6, 2023.

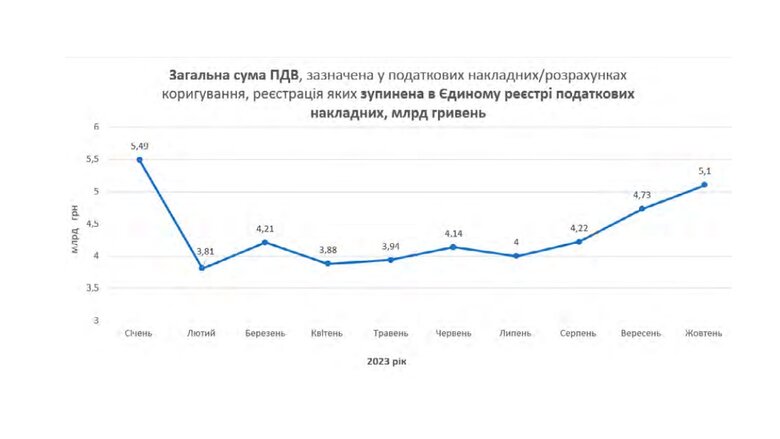

However, the NACP study shows that the total amount of blocked tax credits per month is UAH 4-5 billion. Over 11 months, this is approximately UAH 50 billion.

The issue of a large discrepancy in indicators was raised at the roundtable

"And what is the amount of the tax credit 'suspended' in the RAMS and what is the effectiveness of the RAMS? Mr. Sokur mentioned UAH 167 billion. When I asked him what period of time, he answered: since 2017. A lie upon a lie. Because now this figure is about UAH 1 billion per month, which means that it can be about UAH 12 billion per year," says Nina Yuzhanina, member of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy.

In other words, did the State Tax Service deliberately overestimate the main indicator of the effectiveness of the RAMS- the amount of "correctly" blocked VAT invoices - by 14 times?

The number of risky taxpayers

According to the State Tax Service, the share of risky companies in 2023 was 1.5%. However, it is impossible to calculate how many of them there are because this information is classified. Opening it is one of the key requirements of business.

Currently, companies are often blocked because one of their counterparties is considered risky by the tax authorities. The tax authorities do not provide an answer, citing the prohibition on disseminating information about third parties without their permission.

Moreover, in 2023, many companies will find out about the "riskiness" of their counterparties after successful cooperation in recent years, when they start having problems with blocking VAT invoices. In other words, the RAMS uses the mechanism of retroactive inclusion in the list of risky payers.

Conclusion: before the data is opened, it is impossible to check whether the RAMS really classifies 1.5% of VAT payers as risky. The status of companies is constantly changing, even backdating.

Entrepreneurs are demanding that all the data on why a company is considered risky or why a particular VAT invoice is blocked. Moreover, there are opinions about the inappropriateness of the "risky" status itself.

"There can be no "risky enterprises" as a reason to block something. There may be an additional multiplier for the risk factor to pay extra attention, but no more. In general, if a company is considered "risky," it should be subject to an audit, additional charges, fines, and prosecution of company officials, and that's it. Otherwise, they should clear their good name and say "hello" to the tax authorities," Ihor Diadiura, former Deputy Minister of Economy of Ukraine for Digital Development, Digital Transformation and Digitalization, said on Facebook.

What awaits entrepreneurs in court

According to the State Tax Service, only 0.01% of cases involving the blocking of tax invoices go to court. According to USAID, the non-property claim has a fixed amount - UAH 2,684. This is how much a business has to pay for each appealed decision. And this is without legal support.

In an interview with LIGA.net, Business Ombudsman Roman Vashchuk noted that according to the State Judicial Administration, 90% of disputes over the suspension of tax invoices are resolved in favor of taxpayers.

According to the State Judicial Administration of Ukraine, the status of administration of justice in the category of cases on suspension of tax invoices registration for 9 months of 2023 is as follows:

However, the legislation does not set clear deadlines for the tax authorities to comply with court decisions regarding the registration of VAT invoices, and the State Tax Service takes advantage of this.

Among the main reasons for the failure to comply with court decisions for 2022 and the first half of 2023, the State Tax Service cites restrictions on access to certain data to protect national interests due to Russia's military aggression and forced downtime.

"In fact, the State Tax Service is one of the leaders among government agencies that do not comply with court decisions, which is confirmed, among other things, by court practice," the NACP study says.

Conclusion: A small share of decisions is appealed in courts. Therefore, the State Tax Service's figure of 0.01% seems to be true.

Who does business pay to unblock VAT invoices?

In the fourth quarter of last year, the State Tax Service blocked VAT invoices of 40% of companies. This was the impetus for the development of the segment of consulting services for unblocking VAT invoices.

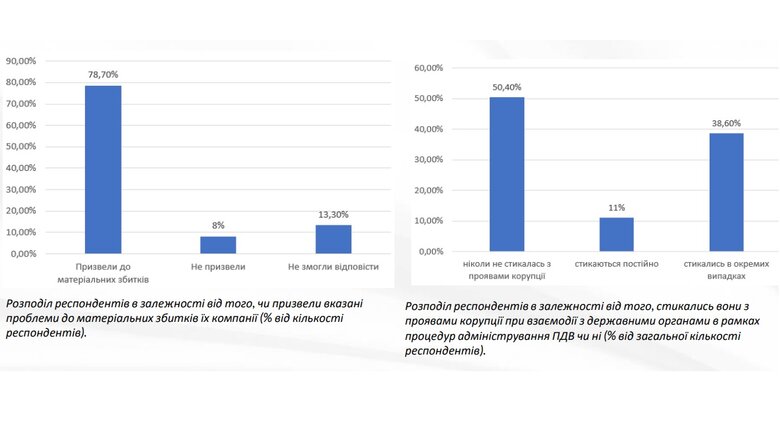

Stable demand, which is met by 25 thousand companies every month, has formed a new segment. According to the USAID study "Topical Issues of Suspension of Taxpayer VAT Invoice Registration," almost 40% of small and medium-sized businesses hire third-party consultants to resolve the issue.

Accounting outsourcing has hired specialists to unblock clients' taxpayer VAT Invoices. Vacancies for specialists in unlocking tax invoices appear on job search sites. Some companies specialize exclusively in this service.

The cost of unlocking a single VAT invoice is from UAH 5 5,000.

However, white consultants face competition from those players who have connections in regional tax authorities.

"For a "separate charge", certain people from the tax office help not only to 'resolve the issue', but also to prepare the necessary documents personally. So to speak, with a guaranteed result. That's all you need to know about effective VAT administration," says Oleksandra Tomashevska, tax consultant at the Kyiv Business Support and Development Center.

Why regional tax authorities are the basis of the corruption system

Starting from January 1, 2021, the State Tax Service is a separate legal entity and operates as a single service that provides unified services throughout Ukraine. But today, businesses must contact their regional tax office to block VAT invoices. And this is the biggest corruption risk.

In the summer of 2023, Business Censor conducted a survey among readers about the unlawful blocking of VAT invoices. Entrepreneurs told us how, after the tax authorities failed to comply with a court decision, they paid bribes to unblock VAT invoices to regional tax commissions.

The cost of a bribe to regional commissions is 2-3% of the total amount of the VAT invoice."This territorial connection, firstly, allows for corrupt pressure on business if a local official has a certain desire to set his or her conditions. Secondly, it gives different interpretations of the same situations. A positive decision is made in Vinnytsia based on the same data table, while a negative decision is made in Zaporizhzhia," explains Laba.

Conclusion: Half of the companies face corruption when interacting with government agencies in the framework of VAT administration procedures. 40% of businesses are clients of consultants, some of whom are connected with regional tax authorities.

New rules of the game

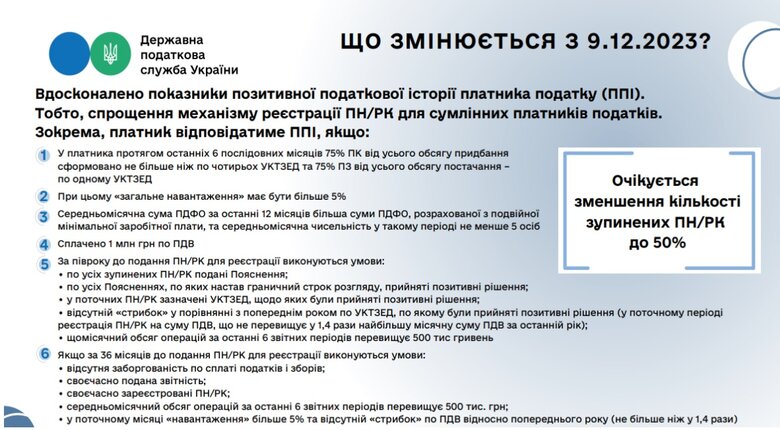

On December 9, 2023, Cabinet of Ministers Resolution No. 1154 came into force, which for the third time in a year changed the rules for registering tax invoices. The State Tax Service believes that the changes will reduce the number of blocked VAT invoices by half.

The innovations concern unconditional registration and positive history. Now, only companies that have paid UAH 10 million in VAT over the past 12 months can apply for unconditional registration. Previously, the criterion was UAH 1 million.

The mandatory criteria for a positive history of a VAT payer are the same UAH 1 million of VAT paid and the presence of 5 employees with double the minimum wage.

"I can say that the latest changes in the algorithms of the RAMS slightly improve the conditions of "imprisoned" VAT payers. Yes, you can change the rules in prison, but prison is prison," says Oleksandra Tomashevska, "Hire a lot of staff, pay high salaries, pay a lot of taxes, and work well and good without blocked invoices.

Conclusion: large companies, which already pay more than 10 million in VAT, will not feel any improvement. Small and medium-sized businesses will lose out or will not feel the changes either, if only because they will still have to pay for the unblocking of all VAT invoices to have a positive history.

The promised reduction in the number of suspended VAT invoices by 50% is unlikely.