The State Tax Service in Ukraine has made headlines recently with numerous legal and ethical issues coming to light. The former leadership was implicated in running a conversion center with a turnover of UAH 15 billion, exposing them to allegations of corruption. Furthermore, the country's Security Service detained senior tax officials in Kyiv for accepting bribes. Simultaneously, the unified tax revenues saw a significant increase, with UAH 45.8 billion collected from taxpayers under the simplified taxation system in the first half of 2025. However, concerns over illegal activities persist, particularly after a company imported a vast quantity of tobacco without excise stamps, hinting at potential illegal production. These developments highlight the critical challenges facing the State Tax Service as it navigates issues of corruption and compliance.

What recent corruption cases involve the State Tax Service?

Recent corruption cases involving the State Tax Service include allegations against former leaders for managing a conversion center with UAH 15 billion turnover and detaining officials in Kyiv for bribery activities.

How have State Tax Service revenues performed in 2025?

The State Tax Service reported a 13% increase in unified tax revenues, collecting UAH 45.8 billion in the first half of 2025, indicating improved financial performance despite existing challenges.

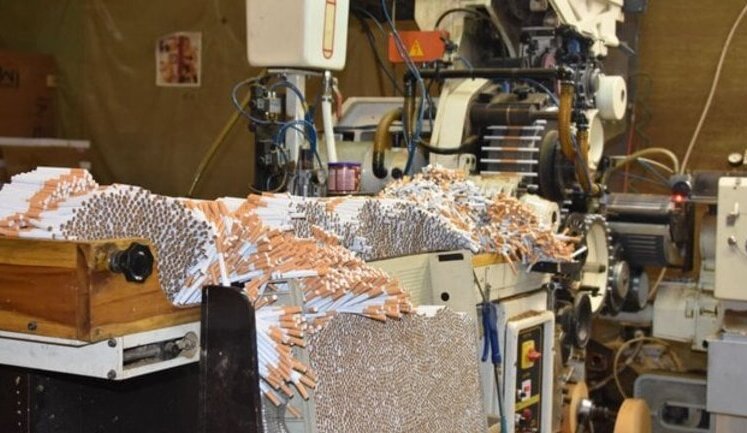

What legal issues surround the tobacco import case in Ukraine?

Luxury Trade Commerce LLC imported 940 tons of tobacco without excise stamps, raising concerns over potential illegal tobacco production, which poses significant legal implications and challenges for authorities.

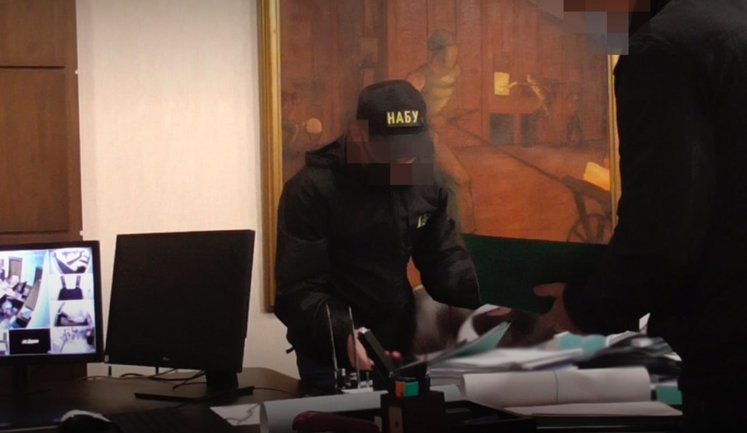

Who was detained in the recent corruption scandal in Kyiv?

The acting deputy head of the Main Department of the State Tax Service in Kyiv was detained by the Security Service for allegedly accepting bribes, highlighting ongoing corruption challenges in the tax sector.

What are the implications of illegal data sales by tax officials?

Three tax officials were caught selling state database information, potentially compromising sensitive data and exposing vulnerabilities in the security practices of the State Tax Service.