Why government cannot stop flow of illegal cigarettes

During a full-scale war, Ukraine is losing tens of billions of hryvnias due to the illegal trade in cigarettes, which should have been used to supply the Armed Forces. BusinessCensor investigated why the government fails to stop the flow of counterfeit tobacco and why it will continue to grow.

How much does the Ukrainian budget lose from illegal cigarettes?

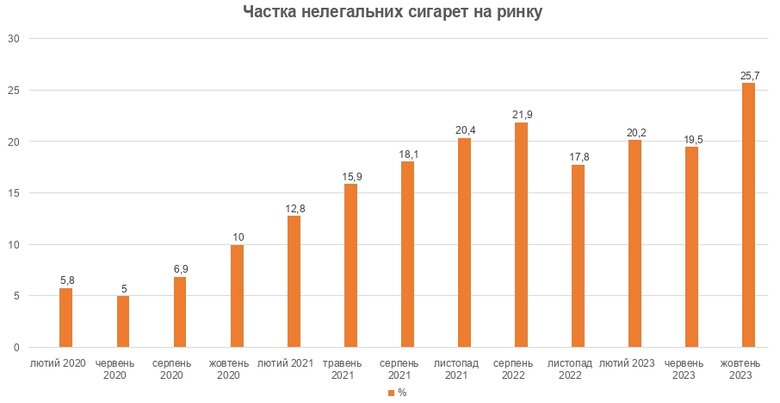

According to market research conducted by Kantar Ukraine in October this year, the share of illegal tobacco products in the market has reached 25.7%. Back in June, this figure was 19.5%. Such a percentage of the "shadow" is an absolute anti-record in the history of research on illegal trade in Ukraine since 2011.

data: Kantar Ukraine

This means that during a full-scale war, every fourth pack of cigarettes is sold without paying the taxes required by law, which Ukraine uses to support the Armed Forces and purchase weapons.

According to Kantar Ukraine, the state budget may lose UAH 23.5 billion in tax revenues this year.

This is more than half of all funds allocated by the government for the "Army of Drones" in 2023 (UAH 40 billion) and significantly exceeds the expenditures for the Defence Intelligence of Ukraine (UAH 18.7 billion), which is forced to raise funds from volunteers to purchase boats and other necessary equipment.

This means that these funds would allow to increase funding for the purchase of drones for the Armed Forces by one and a half times and provide the Ministry of Defense with intelligence officers.

According to Kantar, the leaders in terms of distribution of illegal products are 8 regions of Ukraine, where 70% of such products are sold: Dnipro - 17%, Odesa - 12%, Lviv - 9%; Kharkiv - 9%; Khmelnytsky - 7%; Kirovohrad - 6%; Chernivtsi - 5%, Rivne - 5%. At the same time, kiosks (39%), shops (30%), street vendors (18%), and open markets (11%) remain the main channels for the distribution of illegal products.

According to the data of the State Tax Service, at the same time, the volume of tobacco products legally sold by retailers in almost all of these regions fell significantly in September-October (with the exception of Kirovohrad).

At the same time, Telegram sales channels specializing in small wholesale trade are actively developing: they offer even lower prices for orders of 500 packs or more, thus stimulating the resale of illegal cigarettes through traditional retail channels. Bulk cigarettes without packaging (just in a cardboard box), small wholesale batches of tobacco (including with flavoring additives), filters and cartons for small-scale production of illegal cigarettes have also become available.

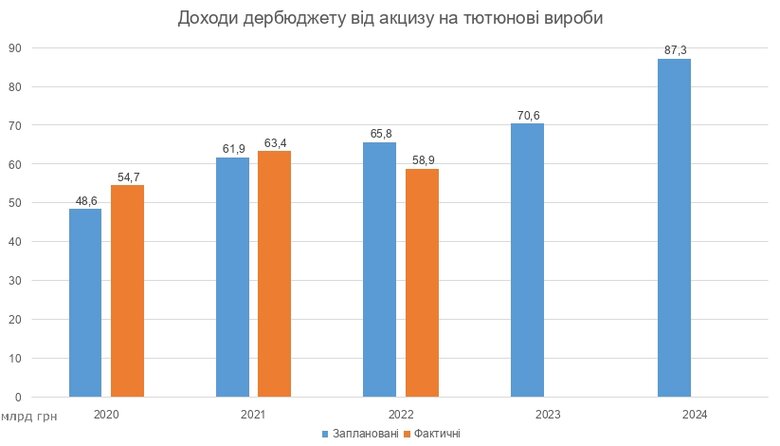

Therefore, despite the annual 20% increase in excise tax rates on tobacco products, in 2022, state budget revenues from tobacco products decreased for the first time in recent years - to UAH 58.9 billion from UAH 63.4 billion in 2021.

Data: laws on the state budget for the respective year, State Treasury Service of Ukraine

Next year, they are expected to grow to UAH 87.3 billion. This is almost as much as the state budget will receive from redirecting the "military personal income tax" to the production of drones and shells. However, the planned state budget revenues from the cigarette excise tax may be in question due to the growth of the illegal market.

However, Danylo Hetmantsev, Chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, assures that excise tax revenues are growing despite the increasing share of illegal products on the market. According to him, legal cigarette production has returned to the level of 2021, and excise tax revenues from tobacco products in January-November 2023 increased by 41.8%, or UAH 21.9 billion, compared to the same period last year.

"According to the results of 2023, we expect to receive UAH 80.3 billion of excise tax on tobacco products, which will ensure that the revenue target (UAH 70.62 billion) is met by 113.7% (plus UAH 9.7 billion). According to preliminary calculations and taking into account the dynamics of production and import of tobacco products, there is no risk of failure to meet the 2024 targets in the current situation," Hetmantsev said.

Why is the "black market" for cigarettes growing?

The share of direct taxes in the retail price of a pack of cigarettes reaches 70-80%. These include excise tax (which has been growing by 20-30% annually since 2017), 5% excise tax on retail sales, and 20% VAT.

In addition, legal producers pay corporate income tax, military duty and labor taxes, as well as other taxes and fees. Participants in the Illegal market avoid paying all or most of these taxes. This makes the illegal tobacco business extremely profitable.

The report of the Temporary Investigation Commission of the Verkhovna Rada to investigate possible violations of the law that could lead to a decrease in revenues to the state and local budgets (ТIC on Economic Security) indicates that some local tobacco producers sometimes pay ten times less taxes than international companies.

Thus, companies with foreign investments pay an average of UAH 3-4 million in taxes per ton of raw materials received. At the same time, data from the Tax Service show that five local manufacturers that imported tobacco raw materials to Ukraine in 2023 paid between UAH 0 and 67 thousand in taxes per ton.

Two types of illegal products are the most common on the Ukrainian market: cigarettes with signs of counterfeiting and products intended for sale in a duty-free zone (labeled Duty Free) or for export and illegally sold in Ukraine.

According to the latest data from Kantar Ukraine, the share of counterfeit tobacco products on the Ukrainian market has increased over the past six months (from 6.9% to 11.3%), as well as the share of so-called "fake Duty Free" cigarettes (to 12.9% from 10.9% in June 2023).

According to the study, 26% of counterfeit cigarettes are produced by Ukrainian Tobacco Production and United Tobacco and have signs of fake excise stamps.

The remaining 74% of counterfeit cigarettes are counterfeits of international tobacco companies' brands that do not have excise stamps at all.

At the same time, the chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, People's Deputy from the Servant of the People party, Danylo Hetmantsev, announced the termination of the United Tobacco factory a year ago, calling it "a significant victory over the 'Russian world' in the Battle of Zhovti Vody."

Now, Hetmantsev claims that despite the appearance of products on sale with the manufacturer's name "Unaidet Tobacco," the factory in Zhovti Vody is not operating.

"As of today, this company does not carry out production activities. The equipment is under control and not in use," the deputy assured.

At the same time, 72% of illegal tobacco products labeled Duty Free or intended for export have an inscription stating that its manufacturer is Vynnykivska Tobacco Factory.

In March, the State Bureau of Investigation (SBI) conducted searches at the factory. They found 1.6 million packs of cigarettes without excise stamps in the manufacturer's warehouse, but no further results of these searches were reported.

What are the risks of illegal cigarettes?

Yaroslav Zhelezniak, chairman of the TCI on economic security, admits that despite appeals to law enforcement, it has not been possible to reduce the volume of illegal cigarette production and sales.

"We have repeatedly handed over both salespoints and specific data on factories that produce illegal products... In short, nothing happened. Law enforcement shields it all up, and the story leads to specific people in power. Every illegal factory operates under the "blanket of protection" of these people," the deputy states.

According to him, there are also cases when law enforcement officers cancel the arrest of large batches of illegal cigarettes allegedly to transfer them for the needs of the military, but in the end they end up back on sale on the "black market".

The main article of the Criminal Code dedicated to combating the illegal production of illicit tobacco products (Article 204 of the Criminal Code "Illegal manufacture, storage, sale or transportation for the purpose of selling excisable goods") falls under the jurisdiction of the Bureau of Economic Security, which has not yet begun its full-fledged work. The reboot of the BES is one of Ukraine's important commitments to its international partners.

"In general, nothing will happen until we reboot the BES, which should be doing this properly," Zhelezniak said.

Oleh Hetman, economist and coordinator of expert groups at the Economic Expert Platform, agrees. However, in his opinion, the work of the TIC managed to mobilize law enforcement agencies.

"They called the heads of the Tax Service, Customs and the National Police. They were forced to report some good news at its meetings. Accordingly, orders were sent down to the regions and the police actually closed the stores that sold counterfeit goods. As soon as the term of the TIC began to expire, the indicators began to rapidly deteriorate," says Hetman.

He notes that since the beginning of 2023, legal cigarette production in Ukraine has begun to recover, but after law enforcement's attention decreased in the fourth quarter, this trend has reversed.

"But in any case, this is "manual control", so it is crucial to finally reboot the Bureau of Economic Security with the participation of international partners, and do the same with the Tax Service. Then, without temporary commissions and without manual control, law enforcement agencies will work properly, but until then, we will have negative results," the expert adds.

Danylo Hetmantsev, Chairman of the Rada's Tax Committee, believes that the already adopted amendments to the legislation will reduce the share of the "black market" in the near future.

"A Kantar study conducted in October shows a high level of operation of the so-called Duty Free scheme, which was still in place because Law No. 3326, which banned such activities, had not yet entered into force," says Hetmantsev.

According to him, this scheme was used by some companies that have official licenses. The termination of the work of the rest of the black market participants directly depends on the effective work of law enforcement.

"There are illegal production facilities, underground workshops that supply the market with cheap products, and law enforcement agencies should work on them," Hetmantsev added. He believes that the adoption of amendments to Law No. 481, which regulates the production and circulation of tobacco products, developed together with the business, will help to close some of the schemes.

Increasing excise taxes instead of fighting the "shadow"

In 2024, the excise tax on tobacco products is scheduled to increase by another 20%. According to Oleh Hetman, this will increase state budget revenues, but the shadow market will also grow.

"Of course, raising the excise tax will increase the shadow share. Perhaps our legislators believe that these are acceptable losses," the expert believes.

The European Business Association calls on the President's Office to fulfill the promise given to business in the summer to actively fight the "shadow" by combining the efforts of all responsible law enforcement and regulatory agencies - the Tax Service, the Prosecutor's Office, the National Police, the Security Service of Ukraine, and to ensure full reform of the Bureau of Economic Security.

The American Chamber of Commerce (ACC) also states that in 2023, legal businesses did not see an effective fight against the illegal tobacco market. At the same time, the authorities are trying to complicate the rules for legal players.

"Over this year the tobacco industry has seen various legislative initiatives appear one after another, such as: ensuring the traceability of excisable products, a ban on the display of legal products, state regulation of the production and circulation of excisable products, another increase in excise taxes for legal products and other legislative innovations that only complicated the activities of legal business and did not eliminate the shadow sector," the ACC emphasizes.

The American Chamber of Commerce called on the authorities to immediately step up efforts to identify and stop the activities of illegal tobacco manufacturers. After all, the shadow market not only distorts competition and harms honest businesses, but also reduces state budget revenues.

"In the context of a full-scale war, insufficient filling of the state budget and slowdown in economic and military assistance from international partners, the growth of the shadow economy, according to business representatives, is unacceptable," the ACC emphasizes.

At the same time, it is worth noting that the Strategy for Combating Illegal Production and Trafficking of Tobacco Products for the Period until 2021, adopted in 2017, has ceased to operate without achieving its goals. A new state action plan in this area has not yet been adopted.

As a result, due to the lack of a systemic policy and the growth of the "shadow market" for tobacco, the state is unable to achieve any of its goals - neither to increase state budget revenues nor to reduce the prevalence of smoking. In addition, the "black market" contributes to the development of crime and corruption in law enforcement agencies, and leads to a deterioration in the working conditions of legal producers, which further affects the economy and tax revenues.