More than two state budgets. How money is being withdrawn from Ukraine

Over the 30 years of Ukraine’s independence, at least $100 billion has been withdrawn from Ukraine abroad, according to Olena Duma, head of the National Asset Recovery and Management Agency (ARMA). At the current exchange rate, this is more than UAH 4 trillion, or more than two state budgets of Ukraine for 2024 in terms of revenue.

In July 2023, the ARMA developed and approved a procedure for the sale of seized assets abroad to recover such assets.

In November last year, the government amended Procedure No. 719, which defines the procedure for seized assets sale at electronic tenders. Only then was it possible to involve foreign trading platforms outside Ukraine, although ARMA has been operating since 2016.

At the same time, the agency cannot choose the buyer on its own but is obliged to create a tender commission with the participation of representatives of the Ministry of Economy and the Ministry of Justice. The latter must select the bidding organizer based on eight criteria. They can be found in the Procedure for selecting legal entities for seized assets sales on a competitive basis.

In short, they are mostly about the participant's availability:

- adequate material and technical base for organizing and conducting the sale of the asset at electronic tenders on the auction principle;

- at least three years of practical experience in the sale of such assets;

- appropriate personnel, such as appraisers, with at least three years of experience in the auction industry;

- the appropriate price offer, etc.

According to Olena Duma, the sale of assets is based on experience: for yachts, it can be a global auction house, for real estate, a real estate agency, and for works of art, specialized platforms.

In addition, the updated Unified State Register of Assets Seized in Criminal Proceedings (USRASCP) is expected to be launched in January 2025.

Currently, the USRASCP contains over 324,000 records, of which 72,000 are assets managed by ARMA.

"As of 2024, ARMA's total portfolio is already UAH 12 billion, of which cash management is UAH 10 billion, UAH 8 billion of which is in military bonds, so they are already working for the Defence Forces," says Olena Duma.

According to her, in January-October 2024, ARMA received UAH 2 billion from the management and sale of seized assets.

"The income from the Ukrainian domestic government loan bonds alone has already totaled UAH 700 million to the state budget. In August, we purchased $31 million worth of military bonds, which brought in $700 thousand in one month. In September, we purchased €6.5 million worth of military bonds," the head of the agency added.

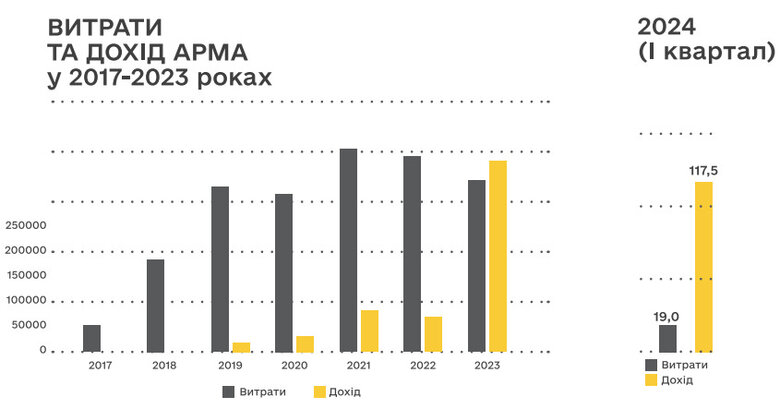

By the way, ARMA began to show such efficiency in 2023, when Olena Duma became the head of the agency. Before that, more money was spent on the institution's maintenance than it brought to the budget.

ARMA's expenditures and revenues for 2017-2023. Source: ARMA report for 2023

The Lazarenko case

Speaking about the withdrawal of money from Ukraine, one cannot but mention the fifth Prime Minister, Pavlo Lazarenko.

As first deputy prime minister, he organized the supply of gas and oil products to the Dnipropetrovsk region, and since 1996 - to Ukraine as a whole through Yuliia Tymoshenko's commercial company United Energy Systems of Ukraine (UESU). Excessive profits were generated by inflating gas prices for Ukrainian consumers. The money was withdrawn, in particular, through the Turkish company United Energy International Limited, a subsidiary of UESU.

In September 1998, the Prosecutor General's Office of Ukraine opened a criminal case against Lazarenko. He was accused of grand embezzlement of state property. But in early 1999, Pavlo Lazarenko left Ukraine. He was detained in New York City while trying to cross the border with a forged passport.

In 2004, Ukrainian businessman Petro Kyrychenko, one of Lazarenko's partners, testified that he transferred $30 million to the official and helped him launder money through Antigua, Switzerland, and Poland.

In August 2006, a California court sentenced Pavlo Lazarenko to nine years in prison and a $10 million fine. The former prime minister was released in November 2012.

In total, Lazarenko managed to withdraw about $200 million from Ukraine. The state is still trying to recover this money.

In August 2024, it became known that the US Department of Justice wanted to seize more than $200 million in favour of Ukraine through a civil forfeiture procedure. Litigation over them has been lasting for about 20 years.

In April 2017, the then Deputy Prosecutor General of Ukraine, Yevhen Yenin, said that the US government planned to return the money stolen by Lazarenko under certain conditions, and not just transfer it to the state budget.

According to Yenin, Petro Lazarenko's defence offered the US government a 50-50 deal, but the offer was rejected.

The matter may move forward after the leaders of the Group of Seven countries agreed to provide Ukraine with $50bn in loans to be repaid from the profits of frozen Russian assets.

Russians withdraw money from Ukraine

Since the beginning of the full-scale invasion of Ukraine, the law has prohibited the removal of Russian owners or beneficiaries from companies. However, despite the restrictions, 621 companies have gotten rid of the Russian trace and not only continue to operate in our country, but they also win millions of dollars in public tenders.

"In 8 out of 10 inspections, the Ministry of Justice proved that the registration actions were illegal. However, the changes have not been canceled, and companies with bleached reputations continue to operate in the Ukrainian market," Opendatabot says.

The Ministry of Justice stated that registration changes may be canceled either by a court decision or if a complaint is filed by a person whose rights have been violated within two months from the date the person learned or could have learned of the violation of their rights, but not later than one year from the date of the relevant decision, action or inaction.

However, in the vast majority of cases, more than one year has passed since the date of re-registration, meaning that the deadline has been missed. At the same time, there is no specific victim of the withdrawal of Russian capital and bleaching of business.

"The situation is rather strange at the moment: Ukraine is demanding that its foreign partners block Russian assets and transfer this money to us, while the Russians are calmly and with impunity withdrawing their capital from Ukraine. This withdrawal is simply not controlled by government agencies whose responsibilities include monitoring of registration actions.

Even if a private company brings a ready-made list of potential violators and government agencies confirm them, nothing happens. The Ministry of Justice cannot eliminate these violations due to the statute of limitations and the absence of a victim.

Which Ukrainian authority will take control of the re-registration of Russian assets and cancel the statute of limitations on such transactions? Who, in the end, should initiate further proceedings in cases where the state of Ukraine is the actual victim? As long as these questions remain open, Russians continue to withdraw their funds, and their businesses continue to make money on Ukrainians and public tenders," emphasizes Oleksii Ivankin, founder of OpenTable.

Billions are being withdrawn in grain

As previously reported by Business Censor, 20% to 50% of Ukrainian grain exports can be used to withdraw currency abroad and launder money.

The "black grain" scheme is used to evade taxation and withdraw currency from the country. Unaccounted-for grain is bought from farmers for cash and registered to fictitious one-day companies that export it abroad.

Along the way, the cargo may change owners several times and is eventually sold to the final buyer. However, the money received remains with one of the intermediary companies and does not return to Ukraine.

Read also: "Black Grain": How billions of dollars are withdrawn from Ukraine and evade taxes"

In an interview with Ekonomichna Pravda last year, Rostyslav Shurma, former deputy head of the Presidential Office, claimed that exporters who exported grain through shadow schemes did not return up to $20bn of their revenue to Ukraine.

"Everyone thinks it was some kind of big centralized scheme. It wasn't. The issue is that it was a completely decentralized story involving hundreds of different kinds of entrepreneurs if you can call them that. These are not big grain traders. Firstly, it is very difficult to administer, and secondly, there are risks associated with the fact that you can lose your credit history, you can get prosecuted. Mostly non-systemic medium-sized companies were involved in this," Shurma said.

In general, the export of "black grain" allows the laundering and withdrawal of profits from other shadowy schemes involving the sale of goods or services for cash. In particular, according to the SSU, this is how organizers of illegal gambling schemes withdrew funds from Ukraine.

Kolomoiskyi's experience

.In 2021, the Pittsburgh Post-Gazette published a large-scale investigation into how Ihor Kolomoiskyi laundered his ill-gotten gains through PrivatBank and Deutsche Bank by purchasing steel factories and real estate in the United States.

The authors of the investigation claim that between 2008 and 2015, Ihor Kolomoiskyi and his partners allegedly stole at least $750 million and then transferred the money through numerous bank accounts opened in Cyprus and the Virgin Islands. Eventually, the funds were transferred to the United States through Deutsche Bank USA, where employees of the institution issued fictitious loans to companies controlled by the oligarch.

Approximately $526.6 million was transferred to firms controlled by Kolomoiskyi and his partners in Delaware, where most of the money was used to buy 18 properties, including nine steel factories, five skyscrapers, two office parks, and a closed Motorola plant northwest of Chicago.

The U.S. Department of Justice has repeatedly filed lawsuits against Ihor Kolomoiskyi and his partners for allegedly withdrawing money from PrivatBank. The claims amount to millions of dollars.

Currently, Ihor Kolomoiskyi has been in a pre-trial detention center in Ukraine for over a year. He is suspected of fraud and misappropriation of PrivatBank funds, as well as of organizing a contract murder in 2003. He has been served several notices of suspicion on different episodes.

According to Kolomoiskyi himself, he was served with the suspicion after a call from America.

Earlier it was reported that the oligarch was deprived of Ukrainian citizenship to facilitate his extradition to the United States. However, there was no request from the Americans.

***

The $100 billion that has been withdrawn from Ukraine since independence is a substantial sum that would have been useful to Ukraine in a full-scale war and an urgent need for external financing of the state budget.

However, at the moment, they are no more than the legendary gold of Hetman Polubotko - everyone knows about the money, but cannot get it. As the story of Lazarenko shows, asset recovery is a time-consuming, laborious process with no guarantees. Therefore, there is no need to count on these funds at the moment.