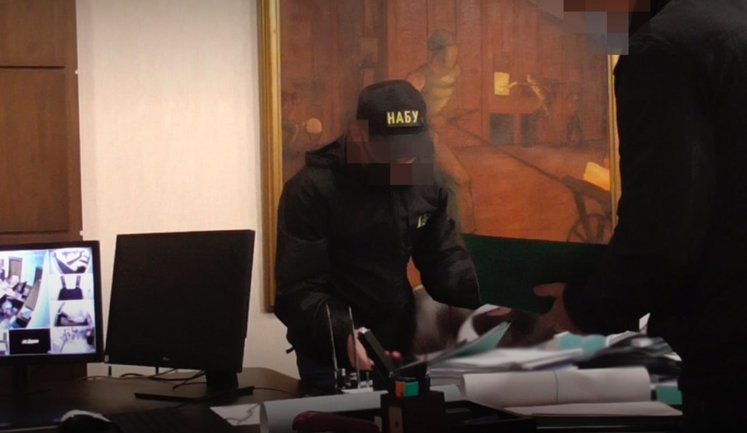

Ukrainian tax police and the Security Service of Ukraine have successfully dismantled numerous illegal tax evasion centers across the country. In Kharkiv and Dnipropetrovsk, officers uncovered an inter-regional currency conversion center with a turnover of about UAH 5 billion. Meanwhile, in Kyiv, an intense operation led to the shutdown of another illegal conversion center after a shoot-out with couriers. These centers have been a major point of concern due to their involvement in significant currency manipulation and tax evasion activities. The operations highlight the ongoing efforts by Ukrainian authorities to curb tax evasion and restore financial integrity in the region.

What actions are being taken against tax evasion centers in Ukraine?

In Ukraine, law enforcement agencies like the tax police and the Security Service are actively targeting illegal tax evasion centers. These authorities have dismantled various currency conversion centers, recuperating billions in illegal turnover, and revealing the extensive operations conducted by these entities.

How significant was the turnover involved in these tax evasion centers?

The dismantled tax evasion centers had significant turnovers, reaching billions of hryvnias. For instance, the center in Kharkiv and Dnipropetrovsk alone managed a turnover of about UAH 5 billion, showcasing the large scale of these illegal financial activities.

What challenges do authorities face in shutting down these centers?

Authorities face multiple challenges, such as the clandestine nature of operation centers, the involvement of large networks spread across regions, and encounters such as shoot-outs, as seen in Kyiv. These challenges complicate efforts to effectively neutralize tax evasion activities.

What role does the SBU play in combating tax evasion?

The Security Service of Ukraine (SBU) plays a crucial role in combating tax evasion by collaborating with other governmental bodies and conducting extensive operations to infiltrate and shut down illegal conversion centers, thereby mitigating their financial impact on the economy.

Are there any penalties for individuals involved in tax evasion activities?

Individuals involved in tax evasion activities face severe penalties, including but not limited to legal prosecution, hefty fines, and imprisonment. The Ukrainian law enforcement agencies are stringent in their pursuit of justice to deter such illegal operations.