Zelenskyy signs law on historic tax increase in Ukraine

President of Ukraine Volodymyr Zelenskyy has signed Law No. 11416-d "On Amendments to the Tax Code of Ukraine on Peculiarities of Taxation during the Period of Martial Law".

According to Censor.NET, this is stated on the Verkhovna Rada's website in the card of this law.

The law provides, in particular:

- Increase in taxes for groups 1, 2, 4 of individual entrepreneurs, with a 10% military tax;

- introduction of advance payments for gas stations;

- establishing a 1% tax on income for private entrepreneurs of the 3rd group;

- 25% tax on profits for non-bank financial institutions;

- monthly reporting on personal income tax.

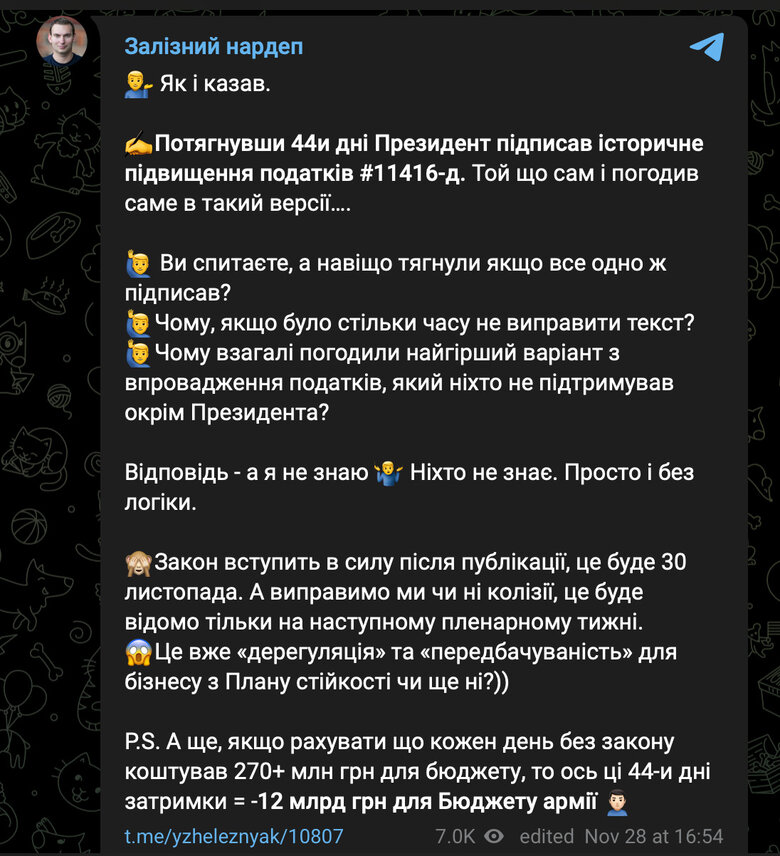

People's Deputy Yaroslav Zhelezniak noted that the President had not signed the law for more than 40 days, which led to losses.

"If we consider that each day without the law cost UAH 270+ million for the budget, then these 44 days of delay = -UAH 12 billion for the army budget," he wrote.

On November 27, the Verkhovna Rada Committee on Finance, Taxation and Customs Policy supported an amendment that would increase taxation for individual entrepreneurs from October 1, 2024 to January 1, 2025.

On October 10, the Parliament adopted as a whole the draft law No. 11416-d on amendments to the Tax Code of Ukraine regarding the peculiarities of taxation under martial law, which provides for an increase in the military tax from 1.5% to 5%, the bank profit tax to 50% in 2024 and an increase in a number of other taxes and fees.