War of drones and war of budgets: Who will win in 2026?

Drone Industry

The rapid development of unmanned technologies in Ukraine has reshaped the logic of funding and procurement so that the innovative solutions the country needs in wartime reach the battlefield as quickly as possible.

If in 2022 drones purchased via the Prozorro system totaled UAH 219 million, then in 2023 the figure rose to UAH 2.6 billion, and in 2024 spending on UAV procurement through the electronic system was six times higher, UAH 15.4 billion.

"2024 became a financial springboard for Ukrainian UAV manufacturers and, at the same time, a point of no return: the drone industry finally took shape as a separate segment of Ukraine’s defense-industrial complex. It was a year of rapid scaling, investment in people, production lines, components, R&D, and more. Many expected this wave to roll over automatically into 2025, with the market remaining under state contracts by inertia. That is why some companies expanded capacity on the assumption that government procurement would continue," DEVIRO says.

Read more: Era of Ukrainian drones that reshaped war. How UAVs evolved on battlefield

According to estimates by the Kyiv School of Economics (KSE), as of 2025, Ukraine is capable of producing up to 10 million UAVs of various types annually and developing new solutions in this field, reinforcing its status as a "drone state." But 2025 revealed a different reality: the state struggled to secure contracts for manufacturers. Order volumes turned out to be lower than what production lines can handle.

"This forced the market to mature. In effect, we have moved from a phase of hypergrowth to a phase of searching for a more sustainable, diversified model. That is the key lesson of the year now ending: a drone manufacturer must be not only an engineer, but also a flexible market player with several sales channels, different customers, and products for different tasks," DEVIRO stresses.

However, developing sales channels inside the country is becoming increasingly difficult for manufacturers. And the export unblocking did not happen this year. At the same time, analysts at the KSE and relevant industry associations stress that domestic companies can produce as many drones as needed to cover national demand and meet demand in foreign markets.

Read more: Arms exports "for our own"? What lies behind president’s statements and what industry really expects

As part of the "Drone Industry" project, Censor.NET examined how the financial side of the sector’s development has evolved and what expectations UAV manufacturers and end users have for 2026.

The market has learned to operate in an environment where companies compete for customers and product quality.

The government began reshaping the UAV procurement landscape in March 2023 by adopting Resolution No. 256, "On implementing an experimental project for conducting defense procurement of domestically produced unmanned systems."

The experimental project was proposed by the then-Ministry for Strategic Industries and the Ministry of Digital Transformation. Its main goal was to streamline defense procurement to meet the needs of the security and defense sector, particularly under martial law, by temporarily exempting purchases from certain control, pricing, and payment requirements. This made it possible to procure equipment faster, with less bureaucracy and with a focus on domestic manufacturers.

The experimental project was set to run until March 2025; however, in December 2024, the government finalized the procedure for procuring domestically produced unmanned systems, tactical-level electronic warfare systems, and their components through the end of martial law, effectively on a permanent basis. To do this, the Cabinet of Ministers amended Resolution No. 1275, which is currently the key document governing defense procurement in general and UAV procurement in particular.

For example, the concept of a framework agreement has been introduced, also referred to as a dynamic purchasing system. It is a two-stage procedure carried out by the Defense Procurement Agency (DPA), the State Operator for Non-Lethal Acquisition (DOT), and the State Special Communications Service. The contracting authority runs electronic tenders among participants that have already been vetted and pre-qualified. Suppliers can apply for the qualification stage throughout the entire term of the framework. Some information in such procurements is available only to the procuring entity and the participating suppliers.

This, in particular, paved the way for decentralizing procurement of UAVs and EW systems and for launching platforms such as Brave1 Market and DOT-Chain Defence, which went live in 2025.

Read more: How DOT-Chain Defence is changing rules of game for Ukraine’s drone industry

"Decentralization is one of the most effective procurement solutions. It has significantly reduced bureaucracy, given procurement officers more freedom, and increased competition among manufacturers, because procurement teams gained the right to choose whose products suit them best," the Wild Hornets company says.

According to Ukrainian Armor CEO Vladyslav Belbas, competition drives prices down and improves quality.

"That’s an axiom. So the more competition there is, the better the quality will be," he stresses.

"The financial landscape of 2025 has shifted. The share of direct contracts with combat brigades and military units rose to 50% — and that is strategically the right move. After all, the end user of our product is the soldier and the commander, who will choose effectiveness and results on the battlefield. At the same time, new sales tools emerged via state marketplaces such as Brave1 Market, which began shaping a more transparent and faster procurement mechanism. External funding sources were added as well: substantial EU support, direct contracts, and programs from partner countries. In the end, 2025 is the year when the market learned to live in conditions of competition for the customer and product quality, not just for budget money," DEVIRO adds.

For example, as of early December, units of the Defense Forces, according to First Deputy Prime Minister and Minister of Digital Transformation Mykhailo Fedorov, had already ordered 148,000 items through Brave1 Market worth UAH 8.5 billion. One advantage of the marketplace is the ability to order needed items using e-points, which are credited to units for verified target kills.

"Manufacturers can offer their products on Brave1 Market, and in exchange for e-points. And if the product is competitive, there will be orders," Wild Hornets emphasizes.

Incidentally, the Cabinet of Ministers has amended the Procedure for Defence Procurement for the period of martial law, allowing state customers to sign long-term contracts to procure weapons with budget funds for up to three years. The decision was adopted to implement instructions from the Supreme Commander-in-Chief’s Headquarters.

The amendments also introduce a new approach to advance payments under defense contracts.

"The approach to advance payments has been updated. The amount and timing are now tied to project milestones. This makes it possible to finance production steadily, without stoppages or cash-flow gaps. This is how we create conditions for launching new production and expanding existing defense-industrial capacity," Prime Minister Yuliia Svyrydenko said.

Procurement decentralisation needs to be scaled up

Procurement decentralization is what the front needs. As service members say, equipment is distributed without taking into account the intensity of combat or the size of the defensive sectors held by individual units. Let alone the needs of specialized units.

"Unit feedback must be taken into account, and funds or equipment should be allocated at least on a proportional basis. For instance, if a unit holds 15% of Ukraine’s defensive line, it should receive a corresponding share of support. The type of capabilities provided also matters. FPV drones alone are not enough, because attacks are now combined. We need bombers as well as mid-range and deep-strike systems if we truly want to influence the battlefield."

I can’t say there have been changes that reflect professional judgment; information from below is not being taken into account at higher levels to manage resources properly. It would be far more transparent if supplies were issued directly to units, which would then decide for themselves what assets they need, of what quality, from which manufacturer, and so on. Instead of a scheme where there are manufacturers, the state, some other people, and only then the units," says one of the officers of a UAV unit in the Kharkiv direction, quoted by the Snake Island Institute.

In an interview with Censor.NET, Ukrainian Armor CEO Vladyslav Belbas said the weapons procurement procedure had already stabilized back in 2024. However, he said the DPA was acting "illogically, inefficiently, and opaquely" at the time.

"Now all of that has changed, but there is one major downside that can outweigh all the advantages: the process is heavily bureaucratized. And that’s a problem. Yes, there are tenders and all of that. But when a tender takes six months, nine months, and then at the end of the year they say, ‘You need to deliver the product within a month,’ no one will be able to fulfill such an order. This process should not drag on indefinitely. So there is one huge drawback in procurement procedures right now — an overly complex, bureaucracy-heavy process that, frankly, does not have much impact on the final cost or delivery timelines, but has a major impact on supplying the Armed Forces of Ukraine," he says.

According to Belbas, DOT-Chain Defence is a good example of decentralization and an anti-bureaucratic approach, and the best examples should be scaled up.

Foreign countries have started investing in Ukraine’s defense industry

Until 2025, international partners did not directly fund Ukraine’s defense sector. The money they provided could be used only for social or humanitarian needs. But as the Russian threat to Europe has grown, especially after Russian Shahed drones carrying warheads nearly reached Warsaw in September, Europeans’ attitude toward the issue has shifted dramatically.

On November 18, it emerged that the EU had for the first time opened up the option of channeling funds from the Ukraine Facility program to support dual-use technologies. This means that, under the new scope, support may be provided to producers of advanced navigation and communications systems, next-generation drones, aerospace technologies, and precision metallurgy.

"The expansion of the Ukraine Facility to dual-use technologies is the result of several months of joint work by Ukraine and the EU. It opens access to financial resources, first and foremost more than 140 million euros, which the EU will channel from the Ukraine Investment Framework into loans and grants for companies. This will enable Ukrainian companies to scale faster, attract investment, and develop products that strengthen the resilience of Ukraine and of Europe as a whole," Deputy Defense Minister Hanna Hvozdiar explains.

In early December, Brave1, a cluster for developing defense tech in Ukraine, launched a new grant program, EU4UA Defence Tech, with a total budget of 3.3 million euros. It became the EU’s first grant program aimed at supporting Ukrainian defense innovation.

"Protecting the skies from Russian drones is a priority not only for Ukraine, but for all of Europe. Thanks to these grants, we will be able to ensure that products capable of significantly strengthening Ukraine’s defense capacity and technological autonomy make it to market," Mykhailo Fedorov notes.

Wild Hornets says cooperation with international partners is a strategic direction:

"Because domestic manufacturers gain experience working with NATO countries for further integration, as well as additional funding to scale up production volumes. At the same time, the state receives additional weapons without spending budget funds, while our foreign partners get the opportunity to draw on our experience to train their troops."

On November 25, the European Parliament adopted a regulation launching the first-ever EU European Defence Industry Programme (EDIP), with a budget of 1.5 billion euros through 2027. The document paves the way for the full integration of Ukraine’s defense-industrial complex into Europe’s and provides for direct financial, technological, and manufacturing support for Ukraine.

The program has three key priorities: promoting joint European defense procurement, expanding the EU’s own production capacity, and moving from improvised solutions to a systematic organization of defense cooperation.

"This is an opportunity to purchase weapons in Ukraine, together with Ukraine and for Ukraine. The programme structurally links the Ukrainian defence industry with the European defence technology base and integrates Ukrainian military innovations into European developments," explains European Commissioner for Defence Andrius Kubilius.

As DEVIRO Technical Director Denys Chumachenko said earlier in an interview with Censor.NET, when the world finances Ukraine, it wants to gain its experience first and foremost:

"Experience in operational employment, rapid development, scaling, and modernization. The normal development cycle for a mid-class UAV is two to two and a half years. In Ukraine, the norm is eight to 12 months. That is exactly what our partners are looking for. What’s more, we already have systems whose performance outpaces many global competitors."

A similar view is echoed in the military. A UAV unit officer in the Kharkiv direction says the issue is precisely the funding Ukraine needs, because in reality, we can help partners more with development right now than they can help us.

The Build in Ukraine and Build with Ukraine programs are particularly important here.

Build in Ukraine

This program aims to integrate Ukraine’s defense-industrial complex into Europe’s defense ecosystem, expand security assistance to Ukraine, and attract additional investment.

"The Build in Ukraine initiative is designed to encourage foreign defense companies to establish production directly in Ukraine. This not only makes it possible to supply the Defense Forces with the required weapons on short timelines, but also turns our country into a full-fledged player in the global defense technology market.

As of today, companies such as BAE Systems (UK), Rheinmetall (Germany), SAAB (Sweden), and Northrop Grumman (US) are operating in Ukraine or rolling out production capacity here. In addition, companies specializing in cutting-edge technologies are entering Ukraine, unmanned systems, cyber defense, and counter-drone systems. This makes it possible to strengthen defense capabilities while also creating new jobs. As of the end of October, more than 25 foreign companies are at various stages of localisation in Ukraine," the Ministry of Defence explains.

Build with Ukraine

"Build with Ukraine is a joint production of defence products/military-industrial complex with foreign partners outside Ukraine. The goal is to duplicate production lines in partner countries to protect domestic facilities from attacks and to build joint ventures on partners’ territory. This reduces risks for critical supply chains, provides investors with safe jurisdictions, and at the same time keeps R&D and key competencies in Ukraine.

Projects under Build with Ukraine are already being worked through with individual countries, including Denmark. "Also, under G2G agreements, critically important production can be moved abroad under joint oversight by partner states to ensure continuous operations even during the war," the Ukrainian Council of Defence Industry (UCDI) says.

According to Yehor Cherniev, deputy head of parliament’s National Security, Defense and Intelligence Committee and head of Ukraine’s Permanent Delegation to the NATO Parliamentary Assembly, Ukraine is already sharing with partners its experience countering Russian drones and missiles, the tools and tactics used to do so.

"We have even invited their soldiers and officers to come to Ukraine for training here; however, so far, they prefer to conduct training on their own territory. We remain open to cooperation with our allies," he says.

Cherniev added that a number of pilot projects are currently being launched in Germany, the Netherlands, the UK, Denmark, and other countries.

"Many countries are interested in our technologies. Poland, in particular, as our closest neighbor, clearly understands that Russia poses the greatest threat to them and to the Baltic states among European countries, and that is why it is moving faster in this direction," the lawmaker said.

Expectations for 2026

For now, neither manufacturers nor the military are willing to look too far ahead. 2025 is ending with a great deal of uncertainty, in particular because of the negotiation track aimed at settling the war. However, certain strategies have already been prepared.

"We have a planning horizon for the first quarter of 2026. Overall, we have two strategies for 2026. Which one becomes the main one will depend on the results of talks on a temporary ceasefire," Wild Hornets says.

DEVIRO says it plans to grow not by inertia, but by relying on several clear strategic pillars that will underpin its development. The first is systematic work with the military.

"This channel will remain our core one. Direct procurement by units and brigades is the new norm of the war. In this type of procurement, the truth becomes clear the fastest: what actually works, what does not, what needs refinement, and what they’re willing to pay for. For a manufacturer, it is also the shortest feedback loop, which means faster product evolution. We expect the number of direct contracts to grow, and their share to be no less than 50% next year as well," the company’s representatives said.

The second pillar DEVIRO will rely on is technological leadership. In their view, in 2026, it will not be those who simply increase the number of airframes who grow, but those who create battlefield relevance.

"That is why we will focus on new functionality and capabilities of our systems. There are not many solutions on the market that are effective, reliable, and affordable at the same time. These three factors will be decisive in 2026 because the war is entering a phase of cost rationalization. We plan to increase R&D spending severalfold next year, using grant assistance programs from European institutions," the company says.

In fact, the Build with Ukraine and Build in Ukraine programs will become DEVIRO’s third pillar:

"This is potentially a major bridge for the next three to five years, but not merely as a source of funding. It is an attempt for manufacturers to achieve scalability by participating in joint projects, and for Ukraine, to build up a long-term technological edge. We expect that in the coming months a clear, workable procedure for manufacturers’ participation in these programs will be put in place. And if it is transparent, the market will get a new wave of growth — no longer an impulse like in 2024, but one on an industrial scale. Financial growth driven by direct contracts with partner countries to meet the needs of the Armed Forces of Ukraine could increase next year, with the share potentially amounting to 30% to 50%."

Earlier, the Tech Force in UA presented three scenarios for the development of Ukraine’s drone market in 2026:

- The "Status quo" scenario outlines a range of challenges Ukrainian manufacturers operate under: limited budget resources and the absence of a unified state policy to support domestic producers. This constrains their growth potential and creates a risk of losing competitive positions both in the domestic market and internationally.

- Implementation of the negative scenario would undermine the country’s defense capability, economic resilience, and the development of the defense-industrial complex: with state orders shrinking and exports remaining impossible, manufacturers would continue looking for relocation options, while state customers would become more dependent on imports and assistance from partner countries.

- The positive scenario would mark a new stage in the development of Ukraine’s defense sector thanks to market-based conditions, long-term contracts, stable state regulation, opportunities to export products and technologies, and the expansion of partnerships with allies.

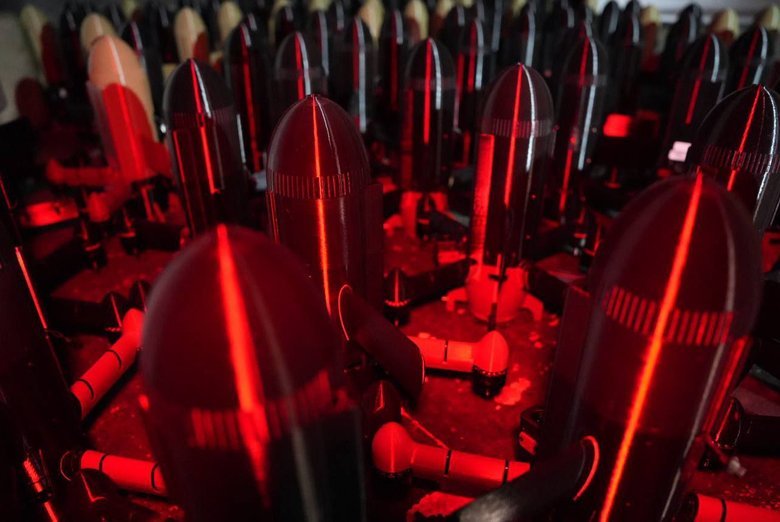

In addition, at the 31st meeting of the Ramstein Contact Group, Ukraine’s Defense Minister Denys Shmyhal announced an ambitious goal: in 2026, Ukrainian companies could produce up to 20 million drones, provided there is adequate funding from partners. In other words, this would mean doubling production capacity. However, what matters here is not the figure that will appear in presentations, but the real capacity to finance manufacturers. After all, it has not yet been possible to load them to 100% capacity in any year of the full-scale war.