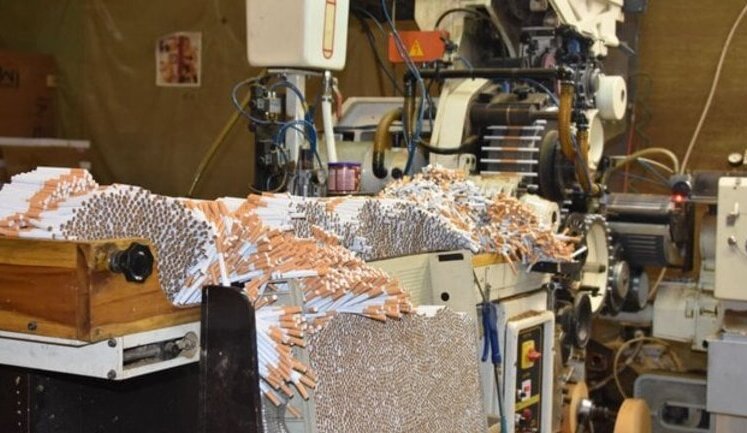

Illegal tobacco production and import remain major issues in Ukraine. A journalist reveals illegal tobacco producers import a third of cigarette filters. Border guards in Bukovyna uncover a shadow business producing counterfeit cigarettes. A container of Marvel-branded cigarettes at Chornomorsk Port highlights a "fictitious export" aimed at smuggling into the EU. Between January and May 2025, nearly 1,000 tons of tobacco entered Ukraine without excise stamps. Such schemes hinder the economy, costing Ukraine millions in lost excise taxes while courts and authorities struggle with enforcement. Business leaders call on Europol and the IMF to counter these shadow market activities.

What are the main issues with tobacco production in Ukraine?

The main issues include illegal production facilities, smuggling of counterfeit cigarettes, and imports of raw tobacco without excise stamps. These activities compromise tax revenues and combat efforts by authorities remain ineffective, partly due to enforcement challenges and corruption.

How does illegal tobacco impact Ukraine's economy?

Illegal tobacco activities lead to significant financial losses for Ukraine. The delay in implementing excise amendments has already caused losses of UAH 579.9 million. The shadow market undermines legal businesses, contributes to corruption, and impacts EU-Ukraine relations.

Why are cigarette filters significant in the tobacco trade?

Cigarette filters are crucial for manufacturing. Controlling their import can indicate illegal production activities. In Ukraine, illegal producers have imported vast quantities of filters without paying necessary excise, pointing to unregulated production potential.

What role does Eurpol play in Ukraine's tobacco issues?

Europol collaborates with Ukrainian authorities to tackle shadow cigarette manufacturers. With G7 and IMF support, there's a concerted push to bolster enforcement mechanisms, disrupt illegal production, and improve legal market conditions, safeguarding Ukraine's economic interests.

Why is the Chornomorsk Port significant in tobacco smuggling?

The Port of Chornomorsk is a point of concern in tobacco smuggling pathways, exemplified by the discovery of a Marvel-branded cigarette container aimed at the EU. These activities exploit Ukraine's transit position, complicating efforts to control and regulate illicit trade routes effectively.

How do Ukrainian courts handle tobacco smuggling cases?

Ukrainian courts frequently encounter challenges with tobacco smuggling cases, often delayed in decisions regarding the property transfer of smuggling activities. This inaction can impede the broader fight against illegal tobacco production, involving complex inter-agency coordination issues.

What are the challenges in combating illegal tobacco producers?

Challenges include sophisticated smuggling techniques, lack of enforcement, legal loopholes, and sometimes corruption within agencies. Business appeals to international bodies highlight the need for a coordinated effort to effectively tackle these illegal operations in Ukraine.